Your DSU membership fees may be withdrawn from Exxon Mobil

The Dalhousie Student Union (DSU) are scheduled to vote tomorrow on whether they will divest their investment portfolio of shares in 16 companies with some of the largest fossil fuel reserves.

The agenda for tomorrow’s DSU council meeting shows they are set to vote on a motion that, if passed, would have the union divest from the 200 Carbon Underground companies.

The agenda includes a report by Mahbubur Rahman, DSU Vice President (Finances and Operations), on the DSU’s investments.

The report says the DSU is invested in 16 of the 200 Carbon Underground companies.

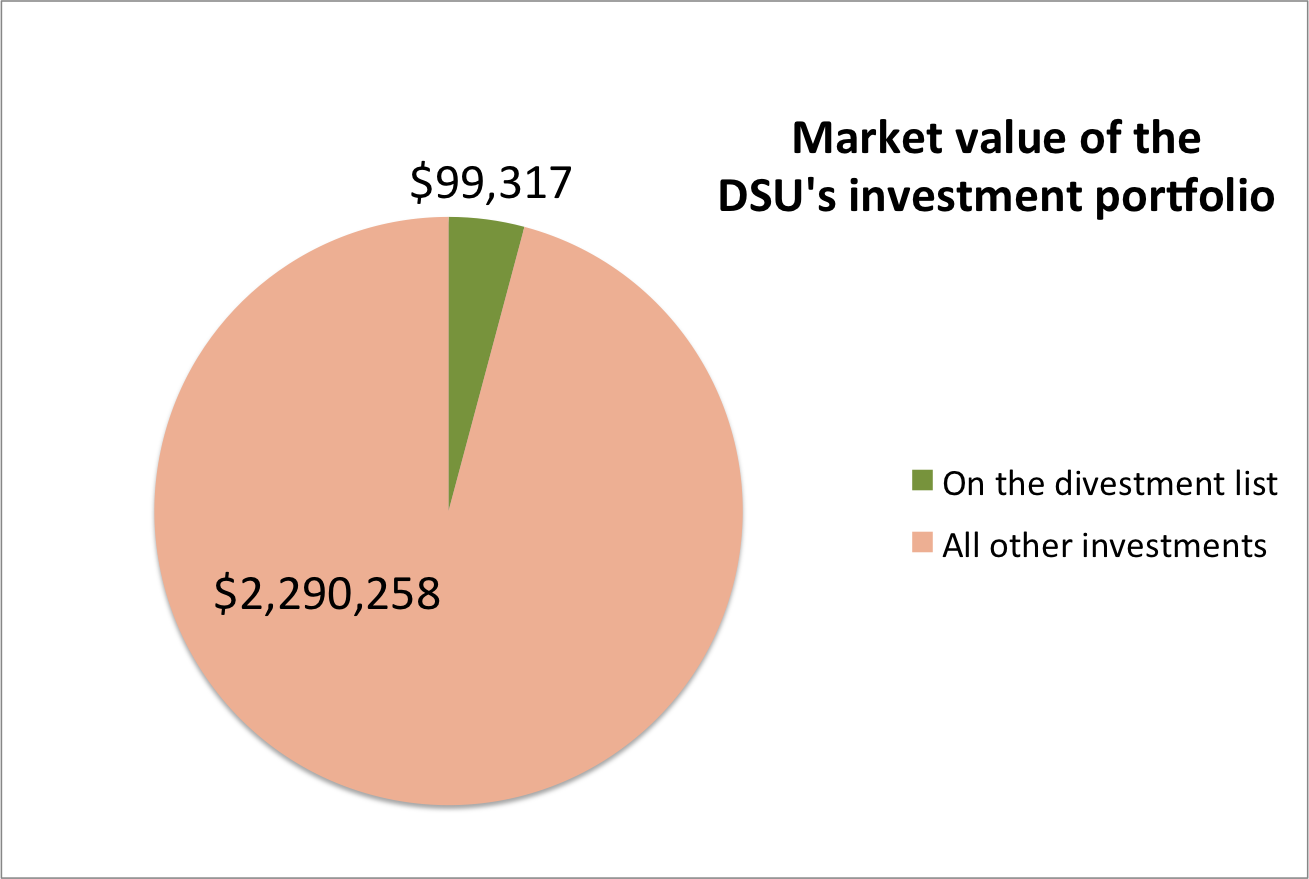

The total market value of these investments is $99,317, which is 4.15 per cent of the investments in their Health Plan reserve. Their entire portfolio is valued at $2,389,575.

Annually, the DSU makes $3,750 from these shares.

In 2013/14, they earned just over $41,000 in revenue from their investments.

Rahman said the union is currently operating with a surplus of $55,000 at the DSU council meeting of Nov. 19.

Rahman’s report says if the DSU votes in favour of leaving these investments, it will be possible to divest within one to two weeks.

DSU hopes divestment would send message to Board of Governors

The DSU’s support for fossil fuel divestiture extends back to the meeting of DSU council on Nov. 20, 2013, when council unanimously voted to support activist group Divest Dalhousie in their campaign to have Dal divest its investment portfolio and make its investments public within four years.

After Dal’s Board of Governors voted at their Nov. 15 meeting to not have Dalhousie divest, the DSU made brief public announcements on Twitter and Facebook about their disappointment in this decision.

DSU President Ramz Aziz is currently out of office on a family matter, according to tomorrow’s council agenda.

DSU Vice President (Internal) Jennifer Nowoselski has been serving as President for over a week and will continue in this capacity until Aziz returns.

Shortly after the Board of Governors voted against divestment, Nowoselski told the Gazette she was disappointed with the result.

She says the DSU will continue to support its societies and members in advocating for divestment through the university, and that the DSU’s vote on divestment will guide its internal direction.

When asked what effects she hopes the DSU’s divestment would have on the Board of Governors – if the DSU does indeed divest – she said, “I would hope that it would send a strong message this is what [the DSU’s] students want.

“And if the university wants to support its students, then they’ll support this as well.”

Because she was only temporarily serving as DSU president, Nowoselski was not allowed last week to sit at the seat of the Board of Governors table currently held by Aziz, even as a non-voting member.

Issues other than divestment that directly affect the DSU were discussed at this meeting.

The meeting saw a vote for Dalhousie to not contribute more than $2,400,000 million to the $10,700,000 total cost of planned renovations to the Student Union Building, as well as a discussion on how two students were recruited to be on the university’s Budget Advisory Committee. Usually, the DSU is consulted in appointing these two students, but this year they were not.

“Decisions were made that we really need to be a part of, and I was really disappointed that they wouldn’t allow me to be in that room or speak,” says Nowoselski.

DSU’s divestment action unadvertised

DSU executives and councillors have discussed divesting the union’s investment portfolio at council meetings since this September, but they have been very quiet about this action.

While the vote to divest is scheduled for tomorrow, and a full list of their investments in the Carbon 200 list is now public, this fact has not been advertised by the DSU in social media, through an email to members, or anywhere else the Gazette is aware of.

What would be divested?

An appendix to tomorrow’s council agenda, embedded below, shows exactly what companies would be divested from.

DSU members may be interested to know that fractions of their membership fees are invested directly in companies like Exxon Mobil and Canadian Oil Sands Ltd.

The DSU has not said whether the rest of their investments will be made public.

Appendix E – DSU Stocks to Be Divested Nov 2014

Recent Comments